44 zero coupon bond face value

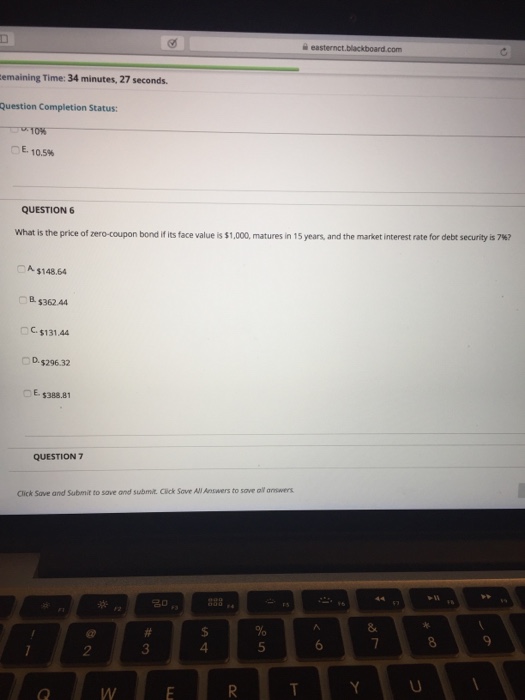

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) Unlike current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bond. read more is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/(1+0.08)^10] Zero Coupon Bond Value - Formula (with Calculator)

study.com › learn › zero-coupon-bond-questions-andZero Coupon Bond Questions and Answers - Study.com A zero-coupon bond with a face value of $100 has one year until maturity. There is a 99% chance you will receive the promised payment in 1 year. The only other possible outcome is getting $0 of the...

Zero coupon bond face value

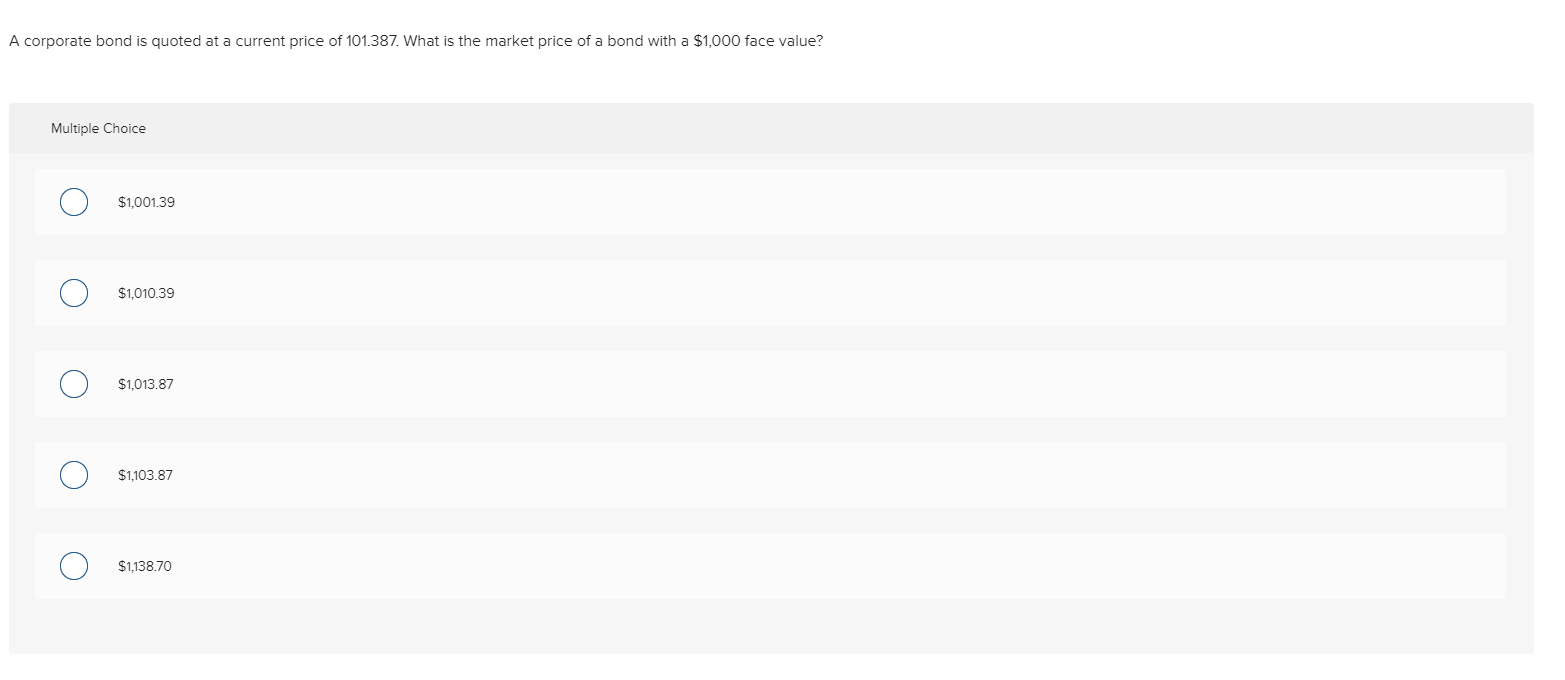

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future ... - DQYDJ Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation. › terms › sStrip Bonds Definition - Investopedia Aug 17, 2020 · Strip Bond: A strip bond is a bond where both the principal and regular coupon payments--which have been removed--are sold separately. Also known as a "zero-coupon bond."

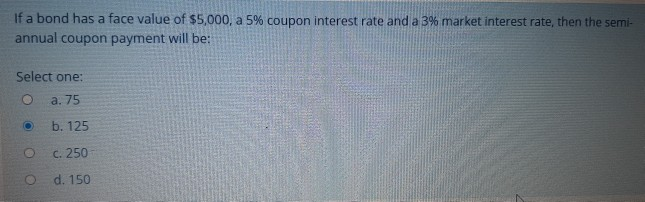

Zero coupon bond face value. Chapter 6 - Corporate Finance Identify the cash flows for both coupon bonds and zero- coupon bonds, and calculate the value for each type of bond. • Calculate the yield to maturity for ...119 pages › terms › zZero-Coupon Bond Definition - Investopedia Feb 26, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › terms › sStrip Bonds Definition - Investopedia Aug 17, 2020 · Strip Bond: A strip bond is a bond where both the principal and regular coupon payments--which have been removed--are sold separately. Also known as a "zero-coupon bond." calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation.

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future ... - DQYDJ Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

A zero-coupon bond is a bond without coupon payments, purchase at a price lower than its face ...

You are offered a zero coupon bond with a 1000 face value and 5 years left to | Course Hero

Post a Comment for "44 zero coupon bond face value"