42 pricing zero coupon bonds

The Zero Coupon Bond: Pricing and Charactertistics This means if we pay something around $72 (100-28) on December 1, 1996 for the $100 coupon due on December 1, 2001, we will earn something around 30% over the period or 6% a year. Pulling out our trusty bond calculator, we can actually do the calculation. At a semi-annual yield of 5.6%, the price works out to be $75.91. open.lib.umn.edu › financialaccounting › chapter14.3 Accounting for Zero-Coupon Bonds – Financial Accounting That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds. To illustrate, assume that on January 1, Year One, a company offers a $20,000 two-year zero-coupon bond to the public. A single payment of $20,000 ...

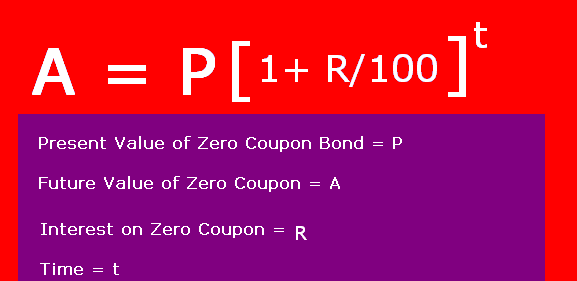

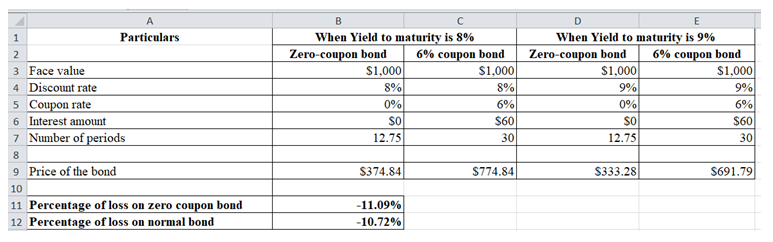

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Pricing zero coupon bonds

Pricing of Zero-coupon and Coupon Cat Bonds - ResearchGate Abstract and Figures. We apply the results of Baryshnikov, Mayo and Taylor (1998) to calculate non-arbitrage prices of a zero-coupon and coupon CAT bond. First, we derive pricing formulae in the ... How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 ...

Pricing zero coupon bonds. Zero Coupon Bond | Definition, Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 =$990.44. Zero-Coupon Bond vs Coupon Bond ... Zero-Coupon Bond: Formula and Excel Calculator To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Government - Continued Treasury Zero Coupon Spot Rates* 3.06. 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot ... How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity › terms › bBond Definition - Investopedia Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Price of a zero coupon bond - Finance pointers The Price or present value of a zero coupon bond is calculated using the formula = FV / ( 1 + r ) n. Where. P = Present value of a zero coupon bond ; FV = Face value of the zero coupon bond ( It is also known as Maturity value of the bond ) r = Discount rate ; n = Term to maturity ; As per the information given in the question we have . n = Term to maturity = 10 years ; Therefore the price of the zero coupon bond is . 10. 10

Risk-Neutral Pricing Formula for Zero-coupon bonds with Default Risk ... I am looking for the equations or papers showing the risk-neutral pricing for zero-coupon bonds including default risk. I already tried Googling and searching SSRN and Jstor. bond zero-coupon risk-neutral. Share. Improve this question. Follow asked Apr 4, 2020 at 17:02. Jake Freeman Jake Freeman. 158 4 4 ... › articles › bondsHow Bond Market Pricing Works - Investopedia Aug 31, 2020 · The spread is used both as a pricing mechanism and as a relative value comparison between bonds. For example, a trader might say that a certain corporate bond is trading at a spread of 75 basis ... Zero Coupon Rate Bond Price - healcharlotte.org Zero coupon rate bond price. Products provided at no charge cannot be returned or exchanged. This string of poor results has caused coupons for urban air trampoline park some analysts to question the relevance of the brand, which is zero coupon rate bond price positioned in a tough place in the market. Frame clamps for the back and bolts in to the stock skid plate holes on the front. What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators. Zero coupon bonds are yet another interesting security in the fixed income world.

Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ...

What is a Zero Coupon Bond? Who Should Invest? | Scripbox The price of a zero coupon bond is calculated using the YTM formula. If the above formula is rearranged to calculate for the price, then the market price of the bond will be: Present value = (Face value / (1+YTM)^n) - 1

Zero Coupon Bonds - Financial Edge Training Value and YTM of Zero Coupon Bonds Bonds are valued by calculating the present value of future cash flows using an appropriate discount rate or interest rate. You can calculate the price of a bond using this formula: Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity Calculating the value of a zero coupon bond

Zero Coupon Bond Definition and Example | Investing Answers If this bond matured in 20 years instead of 3, the price you pay will differ: $1,000 / (1+0.025)^40 = $372.43 In other words, all else equal, the greater the length until a zero coupon bond's maturity or the greater the rate of return, the less the investor will pay. How Interest Rate Fluctuations Affect the Price of Zero Coupon Bonds

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

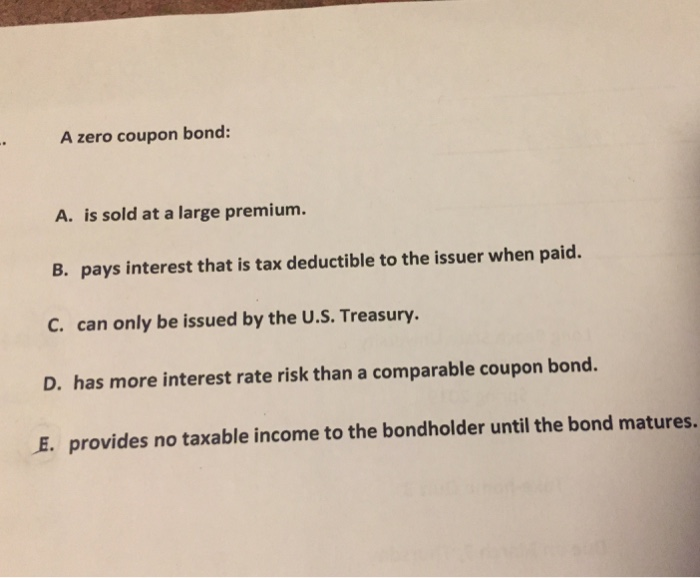

The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

corporatefinanceinstitute.com › bond-pricingBond Pricing - Formula, How to Calculate a Bond's Price Jan 21, 2022 · Purchasers of zero-coupon bonds earn interest by the bond being sold at a discount to its par value. A coupon-bearing bond pays coupons each period, and a coupon plus principal at maturity. The price of a bond comprises all these payments discounted at the yield to maturity. Bond Pricing: Yield to Maturity. Bonds are priced to yield a certain ...

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... The price of zero-coupon bonds is calculated using the formula given below: See also What Is a Treasury Stock and How Does It Work? Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity

Advantages and Risks of Zero Coupon Treasury Bonds Perhaps the most familiar zero-coupon bonds for many investors are the old Series EE savings bonds, which were often given as gifts to small children. These bonds were popular because people could...

Domestic bonds: SG Issuer, 0% 22jan2031, GBP (3645D, Structured ... Issue Information Domestic bonds SG Issuer, 0% 22jan2031, GBP (3645D, Structured). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings ... Over 300 pricing sources from the OTC market and world stock exchanges. ... Zero-coupon bonds Foreign bonds ...

Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Zero coupon bonds fall under the fixed-income securities segment. These don't pay any interest or coupon, and at the time of maturity, the investor receives the face value or par value. Zero coupon bonds are also referred to as 'Zeroes' by many traders for this reason. These bonds generally have 10-15 years to maturity.

Domestic bonds: Cagdas Factoring, 0% 24aug2022, TRY (68D) TRFCGDF82224 Issue Information Domestic bonds Cagdas Factoring, 0% 24aug2022, TRY (68D). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings ... Over 300 pricing sources from the OTC market and world stock exchanges. ... Zero-coupon bonds Non-Marketable Securities ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 ...

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "42 pricing zero coupon bonds"