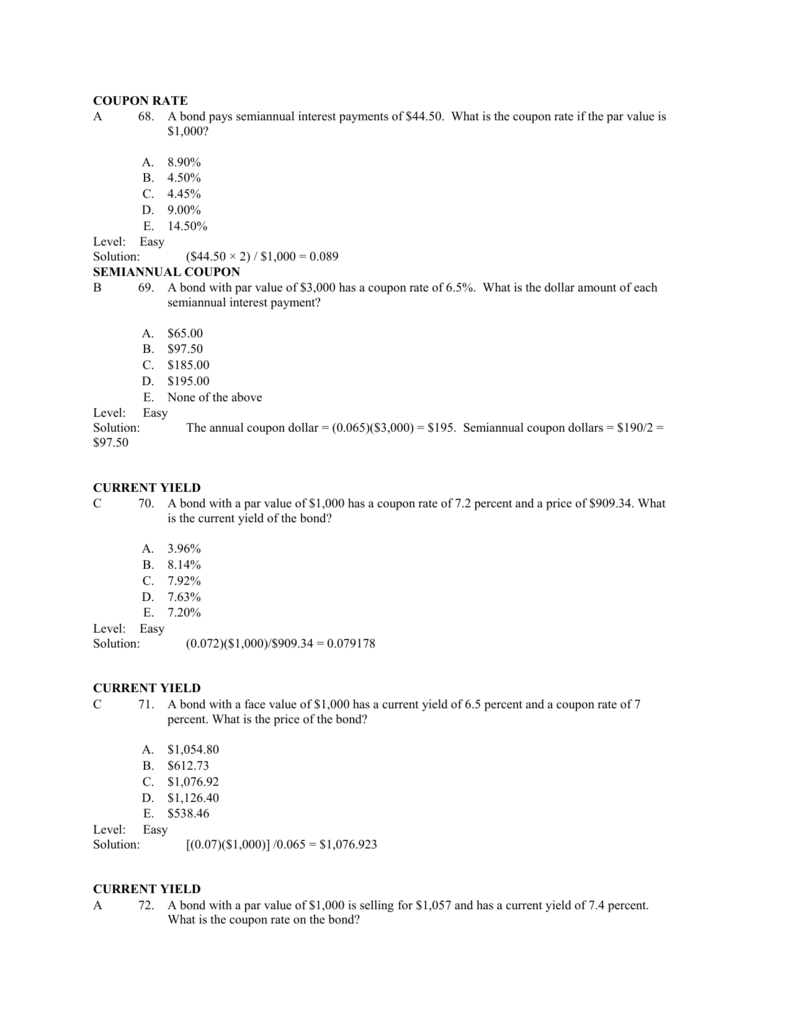

39 coupon rate semi annual

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. Semi-Annual Bond Basis (SABB) Definition - Investopedia Corporate bonds typically pay a coupon semi-annually, which means that, if the interest rate on the bond is 4%, each $1000 bond will pay the bondholder a payment of $20 every six months (a total of...

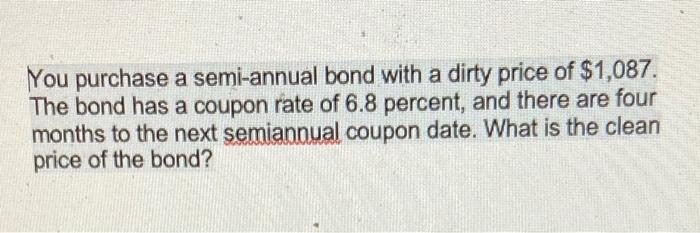

Bond Price Calculator - Belonging Wealth Management A bond's coupon is the interest payment you receive. Use the simple annual coupon payment in the calculator. If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency. For most bonds, this is semi-annual to coincide with the fact that you receive two annual coupon ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Coupon rate semi annual

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate. A bond has an 8% coupon rate (semi-annual interest), a maturity ... - Quora Answer (1 of 5): 1 - You have to find the present value(PV) of the bond's face value of $1,000 using this formula: 2 - PV =FV/[1 + R]^N, where FV=Future value, R=Interest Rate per period, N=Number of periods. 3 - You have to find the PV of the stream of coupons using this formula: PV = P*(((1 +...

Coupon rate semi annual. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Solved 7. Jaeger, Inc. bonds have a 6.39% coupon rate with - Chegg Submit your answer as a percentage and round to two decimal places (Ex. 0.00%) 8. Partzman Co. paid a dividend of $4.52 on its. Question: 7. Jaeger, Inc. bonds have a 6.39% coupon rate with semi-annual coupon payments. They have 8 years to maturity and a par value of $1,000. How to Calculate Semi-Annual Bond Yield | The Motley Fool Its coupon rate is 2% and it matures five years from now. To calculate the semi-annual bond payment, take 2% of the par value of $1,000, or $20, and divide it by two. The bond therefore pays $10...

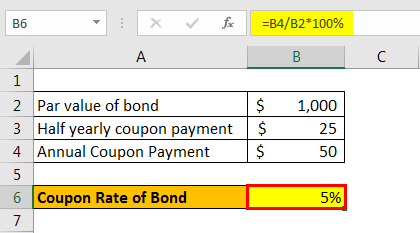

How To Calculate Interest Compounded Semiannually | Indeed.com The formula you would use to calculate the total interest if it is compounded is P [ (1+i)^n-1]. Here are the steps to solving the compound interest formula: Add the nominal interest rate in decimal form to 1. The first order of operations is parentheses, and you start with the innermost one. Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. Coupon Rate: Formula and Bond Yield Calculator Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k each year for as long as the bond is still outstanding. Number of Periods (N) = 2 Coupon Payment = $6,000 / 2 = $3,000 Bond Coupon Rate Calculation Steps Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

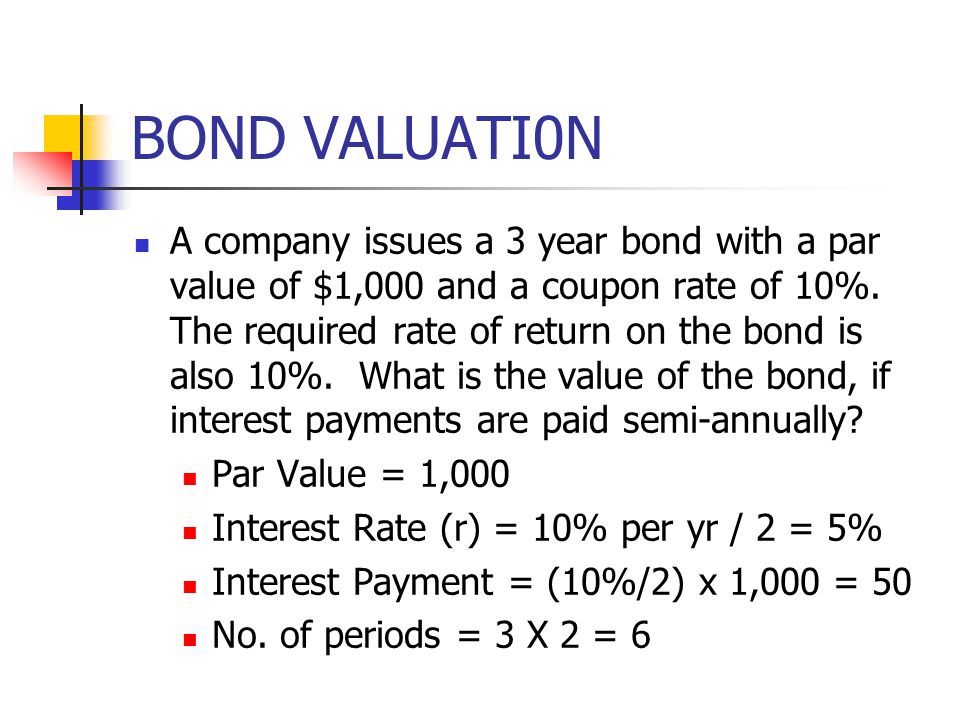

Yield to Maturity vs. Coupon Rate: What's the Difference? bond with a $1,000 face value that is issued with semiannual payments of $10 each. To calculate the bond's coupon rate, divide the total annual interest ... Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. Semiannual coupon and annual coupon | Forum | Bionic Turtle So the rate is 5% per semiannual period which is used to pay coupon at end of each half year. so that for a bond with face value 100 with 10% semiannual couponsmeans that coupons are paid semiannually (at end of each half year) at 10/2%=5% which is (5/100)*100=5 , so the semiannual coupon is 5% because the rate 10% is compounded semiannually.

Bond Prices: Annual Vs. Semiannual Payments | Pocketsense If a bond pays coupon interest semiannually instead of annually, it will compound interest twice rather than once, increasing total bond returns at the end of a year. Part of the bond return is also a reflection of the price paid at purchase. Depending on market interest rates, bond prices can be lower or higher as a result of payment frequencies.

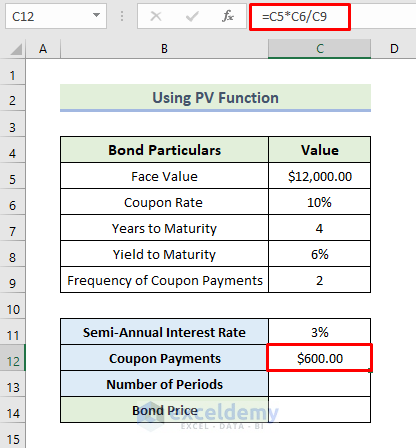

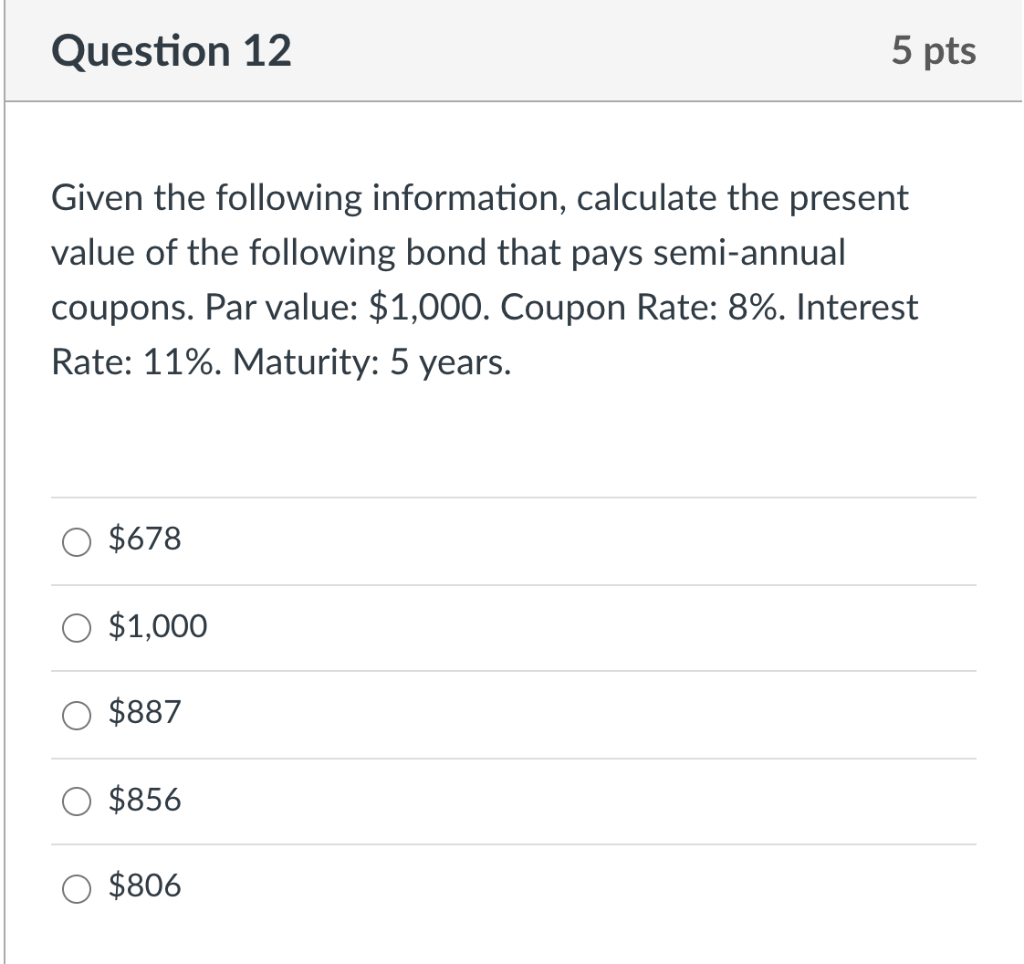

How to Calculate the Price of Coupon Bond? - WallStreetMojo Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

Yield to Maturity Calculator | Good Calculators C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia 1 So with a $1,000 face value bond that has a 10% semi-annual coupon, you would receive $50 (5% x $1,000) twice per year for the next 10 years.

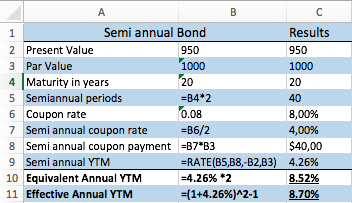

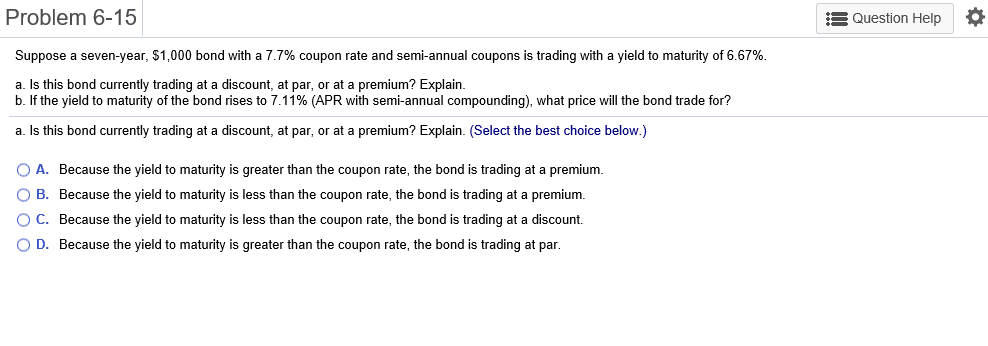

Solved 1. Analyze the 20-year, 8% coupon rate (semi-annual | Chegg.com Question: 1. Analyze the 20-year, 8% coupon rate (semi-annual payment), $1,000 par value bond. The bond currently sells for $1,115. What's the bond's yield to maturity? 5.87% 5.38% 6.93% 6.10% 2. Analyze the 20-year, 8% coupon rate (semi-annual payment), $1,000 par value bond. The bond currently sells for $1,115.

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Semi-Annual Coupon Rate Definition | Law Insider Semi-Annual Coupon Rate means for each Reference Asset, the rate (expressed as a percentage) set forth in the table below: Sample 1 Sample 2 Based on 1 documents Remove Advertising Semi-Annual Coupon Rate Average Annual Debt Service Average Annual Compensation Maximum Annual Debt Service Calculation Rate Payment Rate

Zero Coupon Bond Calculator - Nerd Counter Suppose you have a bond and its face value is $1000 with the present price of $900, and the coupon rate is 2%. Its maturity period is also five years. So, when we calculate the semi-annual bond payment, first of all, we have to get 2% of the face value of $1,000, which is $20, and after that, we have to divide it by two.

Yield to Maturity (YTM): Formula and Calculator - Wall Street Prep Semi-Annual Coupon Rate (%) = 6.0% ÷ 2 = 3.0%; Then, we must calculate the number of compounding periods by multiplying the number of years to maturity by the number of payments made per year. Number of Compounding Periods (n) = 10 × 2 = 20; As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to ...

Coupon Bond Questions and Answers | Homework.Study.com How much will the coupon payments be of a 25 year $5,000 bond with a 8% coupon rate and semi annual payments? A. $800 B. $400 C. $200 D. $67 . View Answer. ... A certain 6% annual coupon rate convertible bond (maturing in 20 years) is convertible at the holder's option into 20 shares of common stock. The bond is currently trading at $800.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Therefore, you would use 5 percent as your required rate of return. Converting Payment Periods Because semiannual coupon payments are paid twice per year, your required rate of return, mathematically speaking, must be cut in half. Therefore, the example's required rate of return would be 2.5 percent per semiannual period.

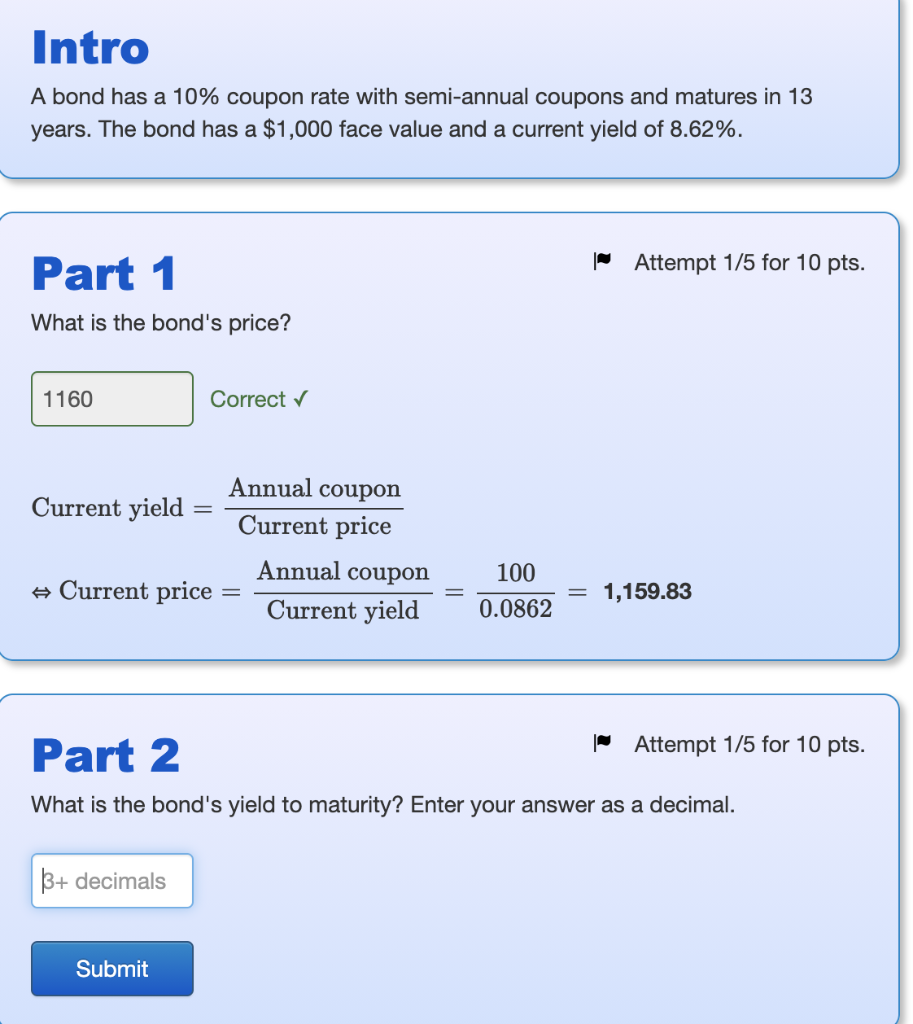

When is a bond's coupon rate and yield to maturity the same? Suppose you purchase an IBM Corp. bond with a $1,000 face value, and it is issued with semi-annual payments of $10. To calculate the bond's coupon rate, divide ...

A bond has an 8% coupon rate (semi-annual interest), a maturity ... - Quora Answer (1 of 5): 1 - You have to find the present value(PV) of the bond's face value of $1,000 using this formula: 2 - PV =FV/[1 + R]^N, where FV=Future value, R=Interest Rate per period, N=Number of periods. 3 - You have to find the PV of the stream of coupons using this formula: PV = P*(((1 +...

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Post a Comment for "39 coupon rate semi annual"