44 payment coupon for irs

› publications › p463Publication 463 (2021), Travel, Gift, and Car Expenses ... Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online. Payments | Internal Revenue Service - IRS tax forms 04.10.2022 · Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Go to Your Account . Pay from Your Bank Account. For individuals only. No registration required. No fees from IRS. Schedule payments up to a year in advance. Pay Now with Direct Pay. Pay by Debit Card, Credit Card or Digital Wallet (e.g., …

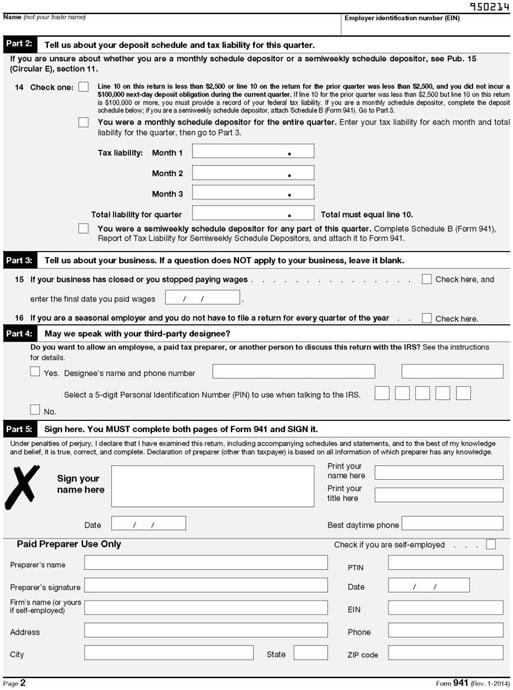

› publications › p15Publication 15 (2022), (Circular E), Employer's Tax Guide Paying the deferred amount of the employer share of social security tax. The CARES Act allowed employers to defer the deposit and payment of the employer share of social security tax. The deferred amount of the employer share of social security tax was only available for deposits due on or after March 27, 2020, and before January 1, 2021, as well as deposits and payments due after January 1 ...

Payment coupon for irs

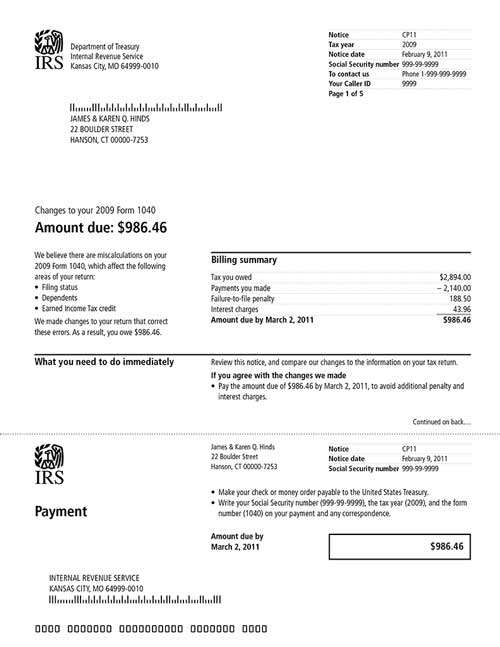

› payPayments | Internal Revenue Service - IRS tax forms Oct 04, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. turbotax.intuit.com › tax-tips › tax-paymentsWhat Is the Minimum Monthly Payment for an IRS Installment ... Oct 18, 2022 · Fees for IRS installment plans. If you can pay off your balance within 180 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 180 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person using Form 9465. apps.irs.gov › app › understandingTaxesModule 1: Payroll Taxes and Federal Income Tax Withholding Key Terms. Federal income tax. The federal government levies a tax on personal income. The federal income tax provides for national programs such as (a) national defense; (b) Veterans and foreign affairs; (c) social programs; (d) physical, human, and community development; (e) law enforcement; and (f) interest on the national debt.

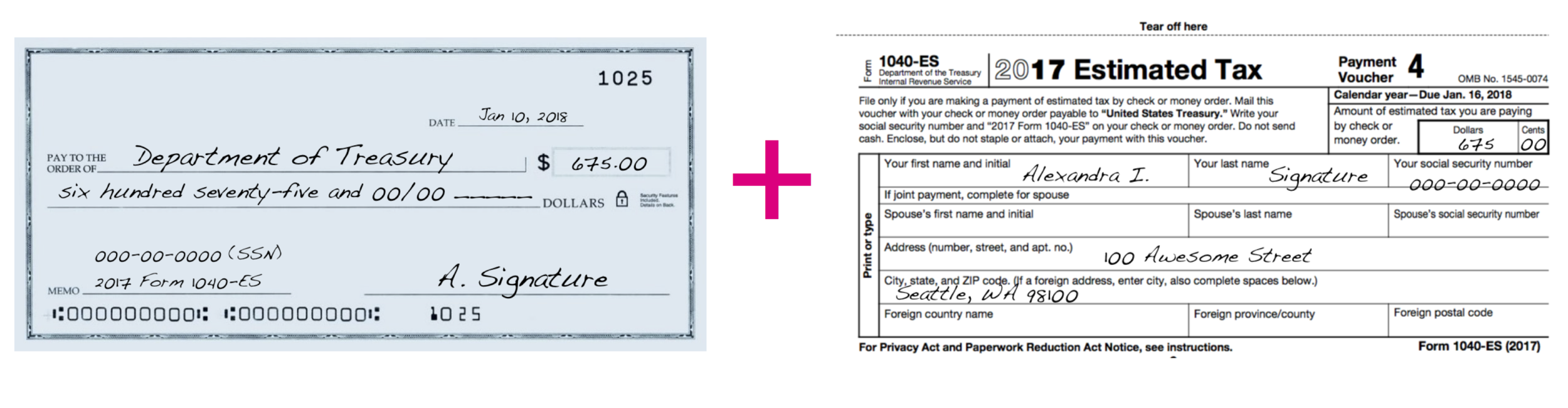

Payment coupon for irs. › tax-center › irsConfirm the IRS Received Your Payment | H&R Block If two weeks have gone by since you sent the last payment and your bank verifies that the check hasn’t cleared your account, call the IRS at 800-829-1040. Ask them if the payment has been credited to your account. If the IRS cash check processing your tax payment hasn’t been completed and your check hasn’t yet cleared, you can: 2022 Form 1040-ES - IRS tax forms 1st payment..... April 18, 2022 2nd payment..... June 15, 2022 3rd payment..... Sept. 15, 2022 4th payment..... Jan. 17, 2023* * You don’t have to make the payment due January 17, 2023, if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return. If you mail your payment and it is postmarked by the › publications › p15aPublication 15-A (2022), Employer's Supplemental Tax Guide 2022 withholding tables. The discussion on the alternative methods for figuring federal income tax withholding and the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members are no longer included in Pub.15-A. This information is now included in Pub. 15-T apps.irs.gov › app › understandingTaxesModule 1: Payroll Taxes and Federal Income Tax Withholding Key Terms. Federal income tax. The federal government levies a tax on personal income. The federal income tax provides for national programs such as (a) national defense; (b) Veterans and foreign affairs; (c) social programs; (d) physical, human, and community development; (e) law enforcement; and (f) interest on the national debt.

turbotax.intuit.com › tax-tips › tax-paymentsWhat Is the Minimum Monthly Payment for an IRS Installment ... Oct 18, 2022 · Fees for IRS installment plans. If you can pay off your balance within 180 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 180 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person using Form 9465. › payPayments | Internal Revenue Service - IRS tax forms Oct 04, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

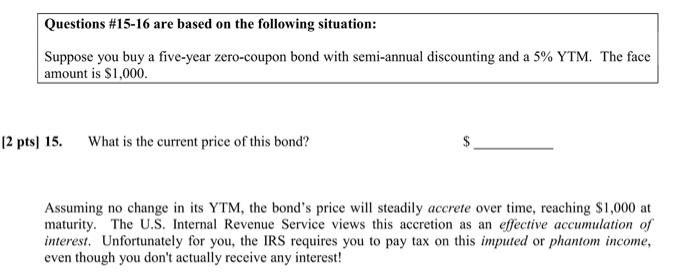

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

Post a Comment for "44 payment coupon for irs"