44 zero coupon bonds advantages

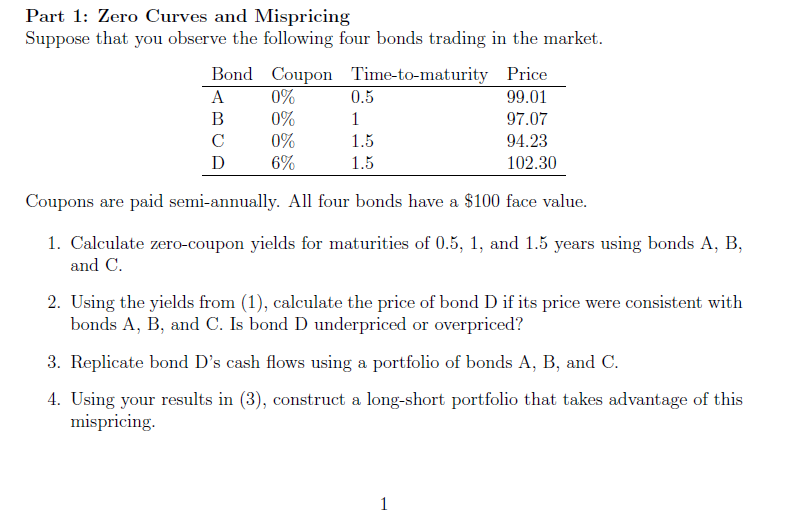

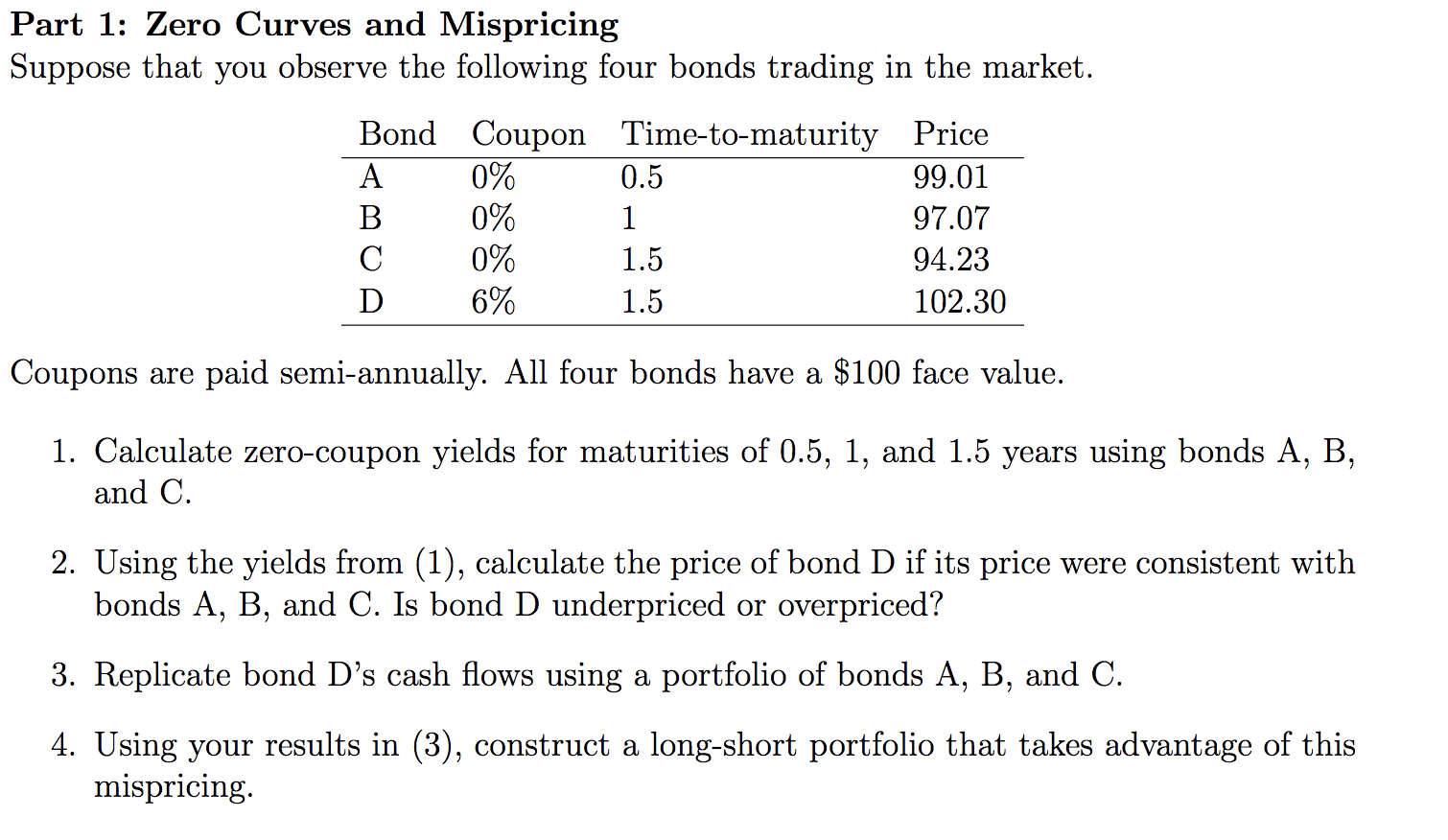

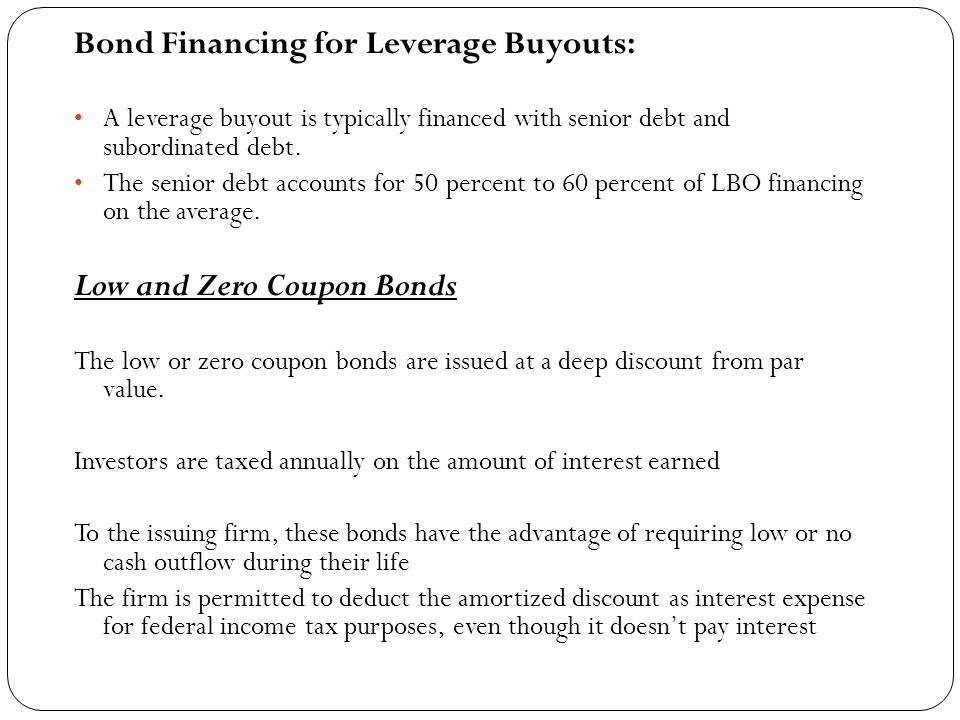

Zero coupon bonds what are the advantages and - Course Hero 1. Zero-Coupon Bonds. What are the advantages and disadvantages to a firm that issues low- or zero-coupon bonds? ANSWER: From the perspective of the issuing firm, low or zero coupon bonds have the advantage of requiring low or no cash outflow during the life of the bond. The issuing firm is allowed to deduct the amortized discount as interest ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. The...

Zero coupon bonds advantages

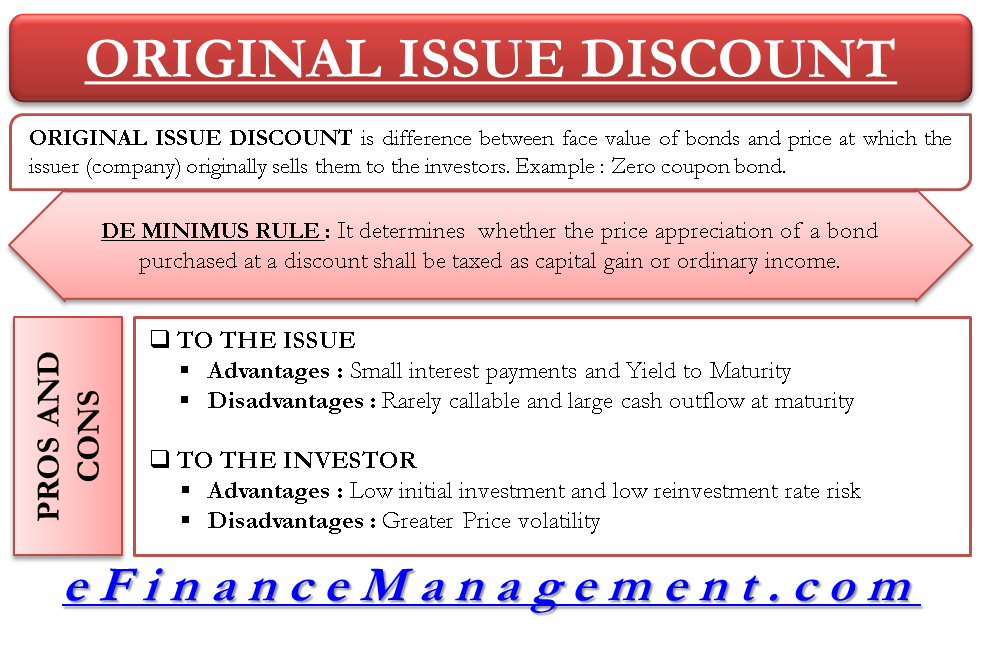

Government Bonds - Meaning, Types, Advantages Sep 12, 2022 · Zero Coupon Bonds. As the name suggests, Zero coupon bonds have no coupon payments. The profits from these bonds arise from the difference in the issue price and redemption value. In other words, these bonds are issued at a discount and redeemed at par. Further, these bonds are not issued through auction but created through existing securities. Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Zero coupon bonds what are the advantages and - Course Hero Low- and zero-coupon corporate bonds are purchased mainly for tax-exempt investment accounts (such as pension funds and individual retirement accounts).Chapter 7: Bond MarketsWEBTo the issuing firm, these bonds have the advantage of requiring low or no cash outflowduring their life. Additionally, the firm is permitted to deduct the amortized ...

Zero coupon bonds advantages. Zero-Coupon Bond - an overview | ScienceDirect Topics In the US market zero-coupon bonds or "zeros" were first issued in 1981 and initially offered tax advantages for investors, who avoided the income tax charge associated with coupon bonds. 6 However the tax authorities in the US implemented legislation that treated the capital gain on zeros as income, thus wiping out the tax advantage. The ... Invest in G-SEC STRIPS India - Bondsindia.com The face value of a G-Strip Bond is Rs 1000. The bond bears a coupon rate of 9% with coupon payments being made at the end of each year. The maturity of the bond is 4 years. If the bond is redeemable at a premium of 11%. What would be the present market price of the bond? What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N'). What is a Zero-Coupon Bond? Definition, Features, Advantages ... Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc.

Achiever Papers - We help students improve their academic standing What advantages do you get from our Achiever Papers' services? All our academic papers are written from scratch. All our clients are privileged to have all their academic papers written from scratch. These papers are also written according to your lecturer’s instructions and thus minimizing any chances of plagiarism. We have highly qualified ... Zero-Coupon Bonds: Pros and Cons Some of the advantages of these bonds have been mentioned below: Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more. Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond? What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them...

What Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · Zero-coupon bonds: Bonds that do not pay interest during the life of the bonds. Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures. Convertible bonds: Can be converted into a different security—typically shares of the same company's common ... Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Advantages and Disadvantages of Bonds | Boundless Finance - Course Hero Zero coupon bonds: A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. ... Advantages of Bonds Bonds have a clear advantage over other securities. The volatility of bonds (especially short and medium dated bonds) is ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Advantages #1 - Predictability of Returns This offers predetermined returns if held till maturity, which makes them a desirable choice among investors with long term goals or for those intending assured returns and doesn't intend to handle any type of Volatility usually associated with other types of Financial Instruments such as Equities, etc.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bonds can be highly beneficial if purchased when the interest rate is high. Purchasing municipal Zero-Coupon can be a great way to avoid tax since they are tax-free. However, this is applicable for investors living in the state where the bond has been issued. Zero-Coupon bonds come with both pros and cons.

What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

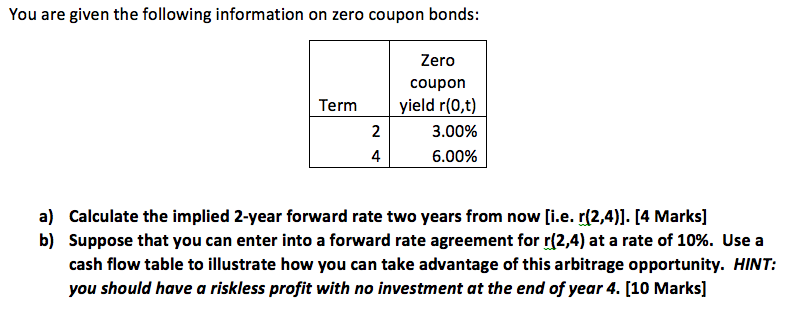

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Zero-Coupon Bond Definition - Investopedia Regular bonds, which are also called coupon bonds, pay interest over the life of the bond and also repay the principal at maturity. A zero-coupon bond does not pay interest but instead trades at a...

What is a zero-coupon bond? What are the advantages and risks? One advantage is that if rates are high, you essentially lock in that rate for the maturity of the bond. if rates go down, they gain value quickly. I can think of two disadvantages. One is that they lose more value if rates go up. The second is the tax treatment.

Invest in Zero Coupon Bond at Yubi | Learn All About It Advantages of Zero-Coupon Bonds. Zero coupon bonds assure a fixed amount of money on maturity. They are a reliable & secure source of fixed returns for investors and an excellent choice for portfolio diversification. A zero coupon bond is immune to short-term market ups & downs. They do not offer any fixed income based on an interest rate ...

Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

All classifieds - Veux-Veux-Pas, free classified ads Website All classifieds - Veux-Veux-Pas, free classified ads Website. Come and visit our site, already thousands of classified ads await you ... What are you waiting for? It's easy to use, no lengthy sign-ups, and 100% free! If you have many products or ads, create your own online store (e-commerce shop) and conveniently group all your classified ads in your shop! Webmasters, …

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Features of Zero-Coupon Bond. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return. Zero Coupon Bonds have no reinvestment risk however they carry interest rate risk. The accumulated interest is paid at the time of maturity. Includes a maturity period of 10 to 15 years.

Zero coupon bonds what are the advantages and - Course Hero Low- and zero-coupon corporate bonds are purchased mainly for tax-exempt investment accounts (such as pension funds and individual retirement accounts).Chapter 7: Bond MarketsWEBTo the issuing firm, these bonds have the advantage of requiring low or no cash outflowduring their life. Additionally, the firm is permitted to deduct the amortized ...

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Government Bonds - Meaning, Types, Advantages Sep 12, 2022 · Zero Coupon Bonds. As the name suggests, Zero coupon bonds have no coupon payments. The profits from these bonds arise from the difference in the issue price and redemption value. In other words, these bonds are issued at a discount and redeemed at par. Further, these bonds are not issued through auction but created through existing securities.

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "44 zero coupon bonds advantages"