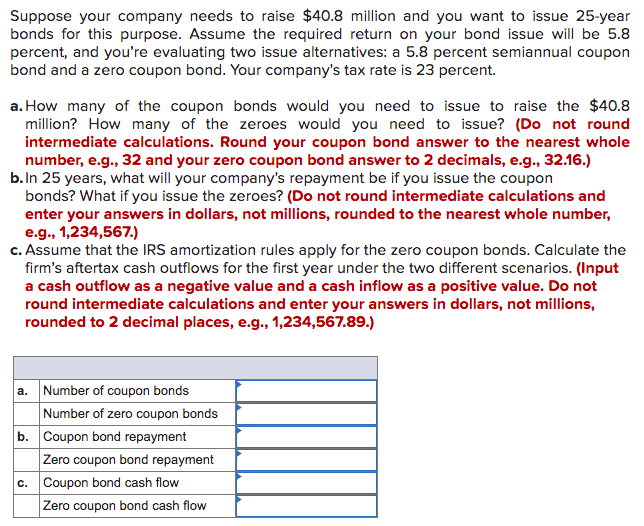

42 zero coupon bonds tax

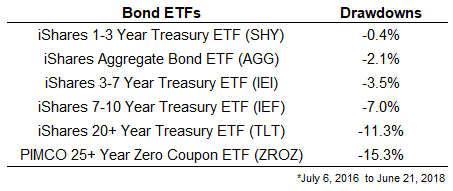

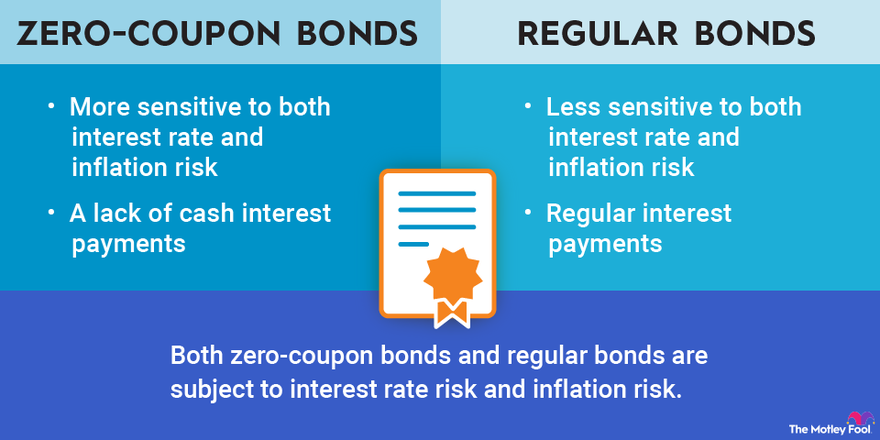

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... Government Bonds: Types, Benefits & How to invest - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction.

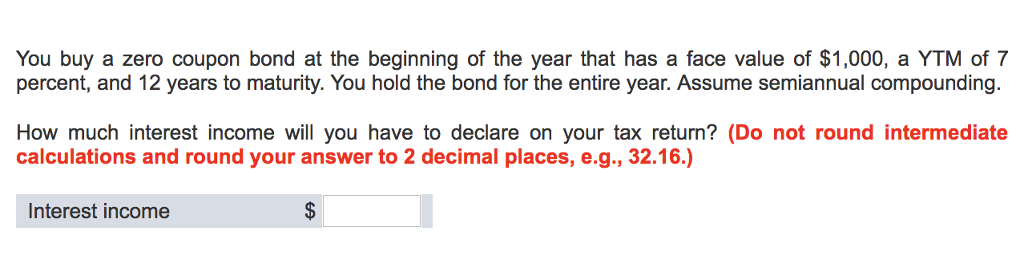

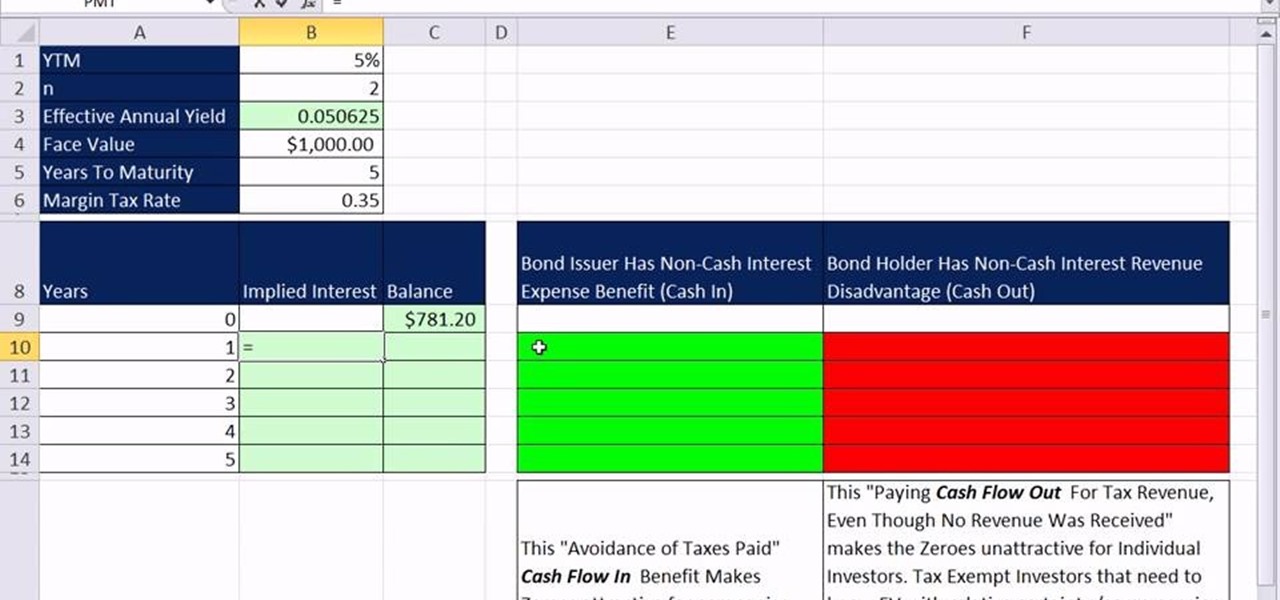

Zero Coupon Bond Calculator – What is the Market Price ... In the United States, you need to impute the interest for some zero coupon bonds to pay taxes in the current year (possibly also for state or local taxes). One tax workaround is to purchase zero coupon bonds in tax-free accounts such as IRAs, or to purchase zero coupon municipal bonds with no tax obligations. Consult your tax advisor for a full ...

Zero coupon bonds tax

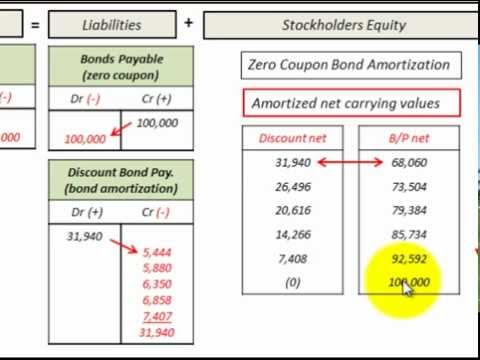

Zero-Coupon Bonds and Taxes - Investopedia Aug 31, 2020 · Zero-coupon bonds are more volatile than coupon bonds, so speculators can use them to profit more from anticipated short-term price movements. ... In the U.S., zero-coupon bonds create a tax ... Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Zero-Coupon Bonds: Characteristics and Examples Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula

Zero coupon bonds tax. What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Zero-Coupon Bonds: Characteristics and Examples Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Zero-Coupon Bonds and Taxes - Investopedia Aug 31, 2020 · Zero-coupon bonds are more volatile than coupon bonds, so speculators can use them to profit more from anticipated short-term price movements. ... In the U.S., zero-coupon bonds create a tax ...

Post a Comment for "42 zero coupon bonds tax"